PM SVANidhi Loan Scheme

TOI news dtd 28th April 2022. Extended the loan providing scheme till 2024 Dec with an enhancing of 3100 core budget. (Earlier it was 5000 crore which became 8100 crore after enhancing)

Modi governments loan schemes for a crore of street vendors are one of the biggest bold and proper step taken by PM Modi to improve Indian economy in the micro-level.

The COVID-19 pandemic and consequent lockdowns have adversely impacted the livelihoods of street vendors. They usually work with a small capital base and might have consumed the same during the lockdown. In order to help such vendors, the government announced the PM SVANidhi loan scheme.

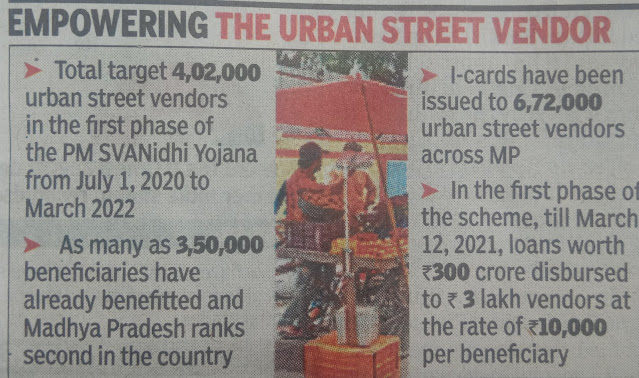

This scheme targets to benefit over 50 lakh Street Vendors who had been vending on or before 24 March 2020, in urban areas including those from surrounding peri-urban/rural areas. Under the Scheme, the vendors can avail a working capital loan of up to Rs.10,000, which is repayable in monthly instalments in the tenure of one year.

On timely/early repayment of the loan, an interest subsidy at 7% per annum will be credited to the bank accounts of beneficiaries through Direct Benefit Transfer (DBT) on a quarterly basis. There will be no penalty on early repayment of loan. The scheme promotes digital transactions through cashback incentives up to an amount of Rs 100 per month. Moreover, the vendors can achieve their ambition of going up on the economic ladder by availing the facility of enhancement of the credit limit on timely/early repayment of the loan.

Eligibility of States/UTs:

The Scheme is available for beneficiaries belonging to only those States/UTs which have notified Rules and Scheme under Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014. Beneficiaries from Meghalaya, which has its own State Street Vendors Act may, however, participate.

Eligibility Criteria of Beneficiaries: The Scheme is available to all street vendors engaged in vending in urban areas as on or before March 24, 2020. The eligible vendors will be identified as per the following criteria:

Street vendors in possession of Certificate of Vending / Identity Card issued by Urban Local Bodies (ULBs);

The vendors, who have been identified in the survey but have not been issued Certificate of Vending/Identity Card;

Street Vendors left out of the ULBled identification survey or who have started vending after completion of the survey and have been issued Letter of Recommendation (LoR) to that effect by the ULB / Town Vending Committee (TVC); and

The vendors of surrounding development/peri-urban/rural areas vending in the geographical limits of the ULBs and have been issued Letter of Recommendation (LoR) to that effect by the ULB/TVC.

Scheme details: Urban street vendors will be eligible to avail a Working Capital (WC) loan of up to Rs 10,000 with tenure of 1 year and repaid in monthly instalments. For this loan, no collateral will be taken by the lending institutions. On timely or early repayment, the vendors will be eligible for the next cycle of the working capital loan with an enhanced limit. No prepayment penalty will be charged from the vendors for repayment before the scheduled date.

Rate of Interest: In case of Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Cooperative Banks & SHG Banks, the rates will be as per their prevailing rates of interest. In the case of NBFC, NBFC-MFIs etc., interest rates will be as per RBI guidelines for respective lender category. In respect of MFIs (non-NBFC) & other lender categories not covered under the RBI guidelines, interest rates under the scheme would be applicable as per the extant RBI guidelines for NBFC-MFIs.

Interest Subsidy: The vendors, availing loan under the scheme, are eligible to get an interest subsidy at 7%. The interest subsidy amount will be credited into the borrower’s account quarterly. Lenders will submit quarterly claims for interest subsidy for quarters ending as on June 30, September 30, December 31 and March 31 during each financial year.

The subsidy will only be considered in respect of accounts of borrowers, which are Standard (non-NPA as per extant RBI guidelines) on respective claim dates and only for those months during which the account has remained Standard in the concerned quarter. The interest subsidy is available up to March 31, 2022. The subsidy will be available on first and subsequent enhanced loans up to that date. In the case of early payment, the admissible amount of subsidy will be credited in one go.

It is worth mentioning that the Ministry of Housing and Urban Affairs recently launched the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) App. The ministry has already launched the website on June 29, 2020, and the app has all the features similar to the web portal of PM SVANidhi. The features include vendor search in the survey data, e-KYC of applicants, processing of applications, and real-time monitoring.

The app can be downloaded from the Google Play store for use by the Los and their field functionaries. Since the commencement of lending process under PM SVANidhi on July 02, 2020, over 1,54,000 Street Vendors have applied for working capital loan across States/UTs and out of which over 48,000 have already been sanctioned.

Information collected and uploaded on this blog page by me on...

Sudesh DJV

Indore MP India

30th July 2020

Sudesh DJV writes on contemporary subjects in the form of Articles and poems which is in the interest of the Nation in particular and for Mankind in general.

.jpg)

Comments